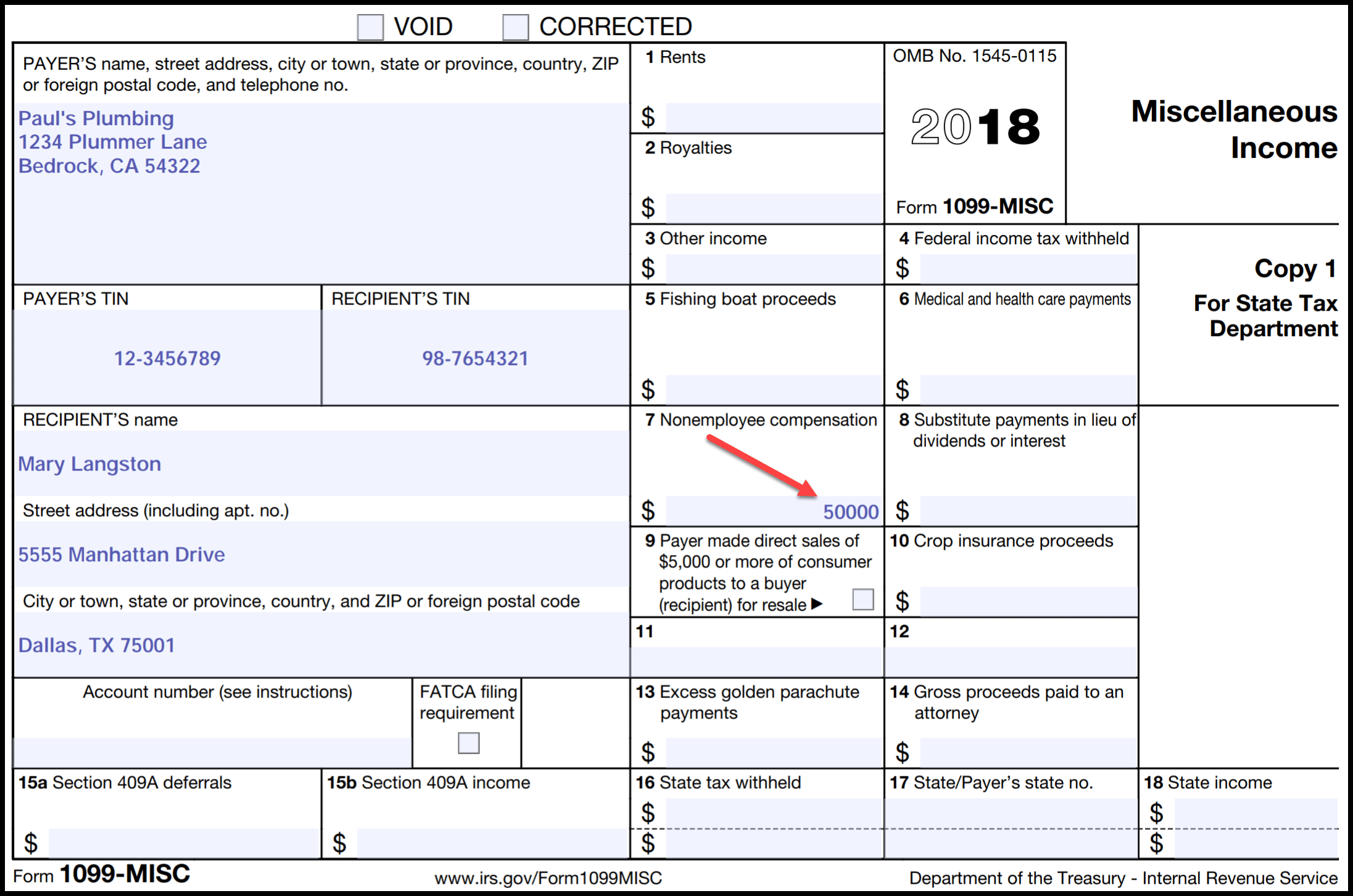

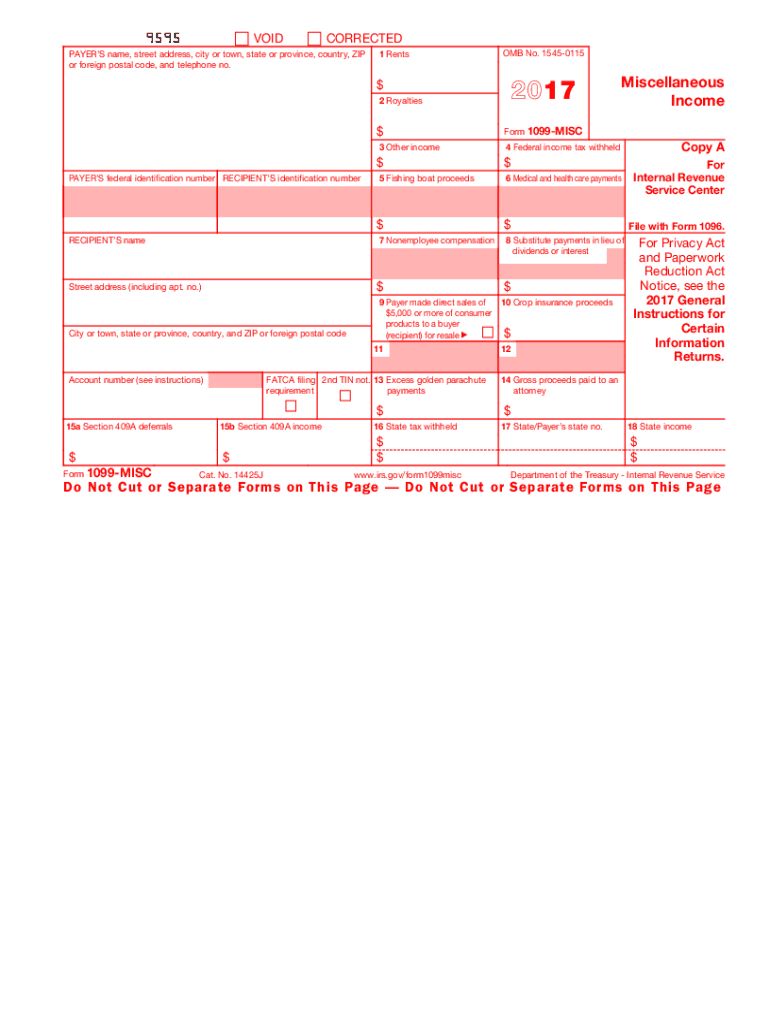

A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the companyA 1099 is a form used to report nonemployment income such as dividends earned by owning stock or earnings you earn through an independent contractor Because there are so many income sources, you'll require a variety of 1099 forms Taxpayers have to report income to the IRS, regardless of whether you've received all of your 1099 formsThere are more than 1099 Forms Among then, 1099 MISC Form is familiar one A 1099 MISC is used for miscellaneous income This is going to be the most important 1099 for independent contractors

1099 Misc Form Fillable Printable Download Free Instructions

1099 form independent contractor 2019 pdf

1099 form independent contractor 2019 pdf- Note If you're unsure whether a worker is an employee or an independent contractor, you can submit Form SS8 to the IRS for an official designation What's the difference between 1099 and W2?Estimated Income Tax Payments for 21, 22 online Calculate Your Estimated Income Tax Payments with Form 1040ES for Tax Year 21 and 22 Now Detailed Overview

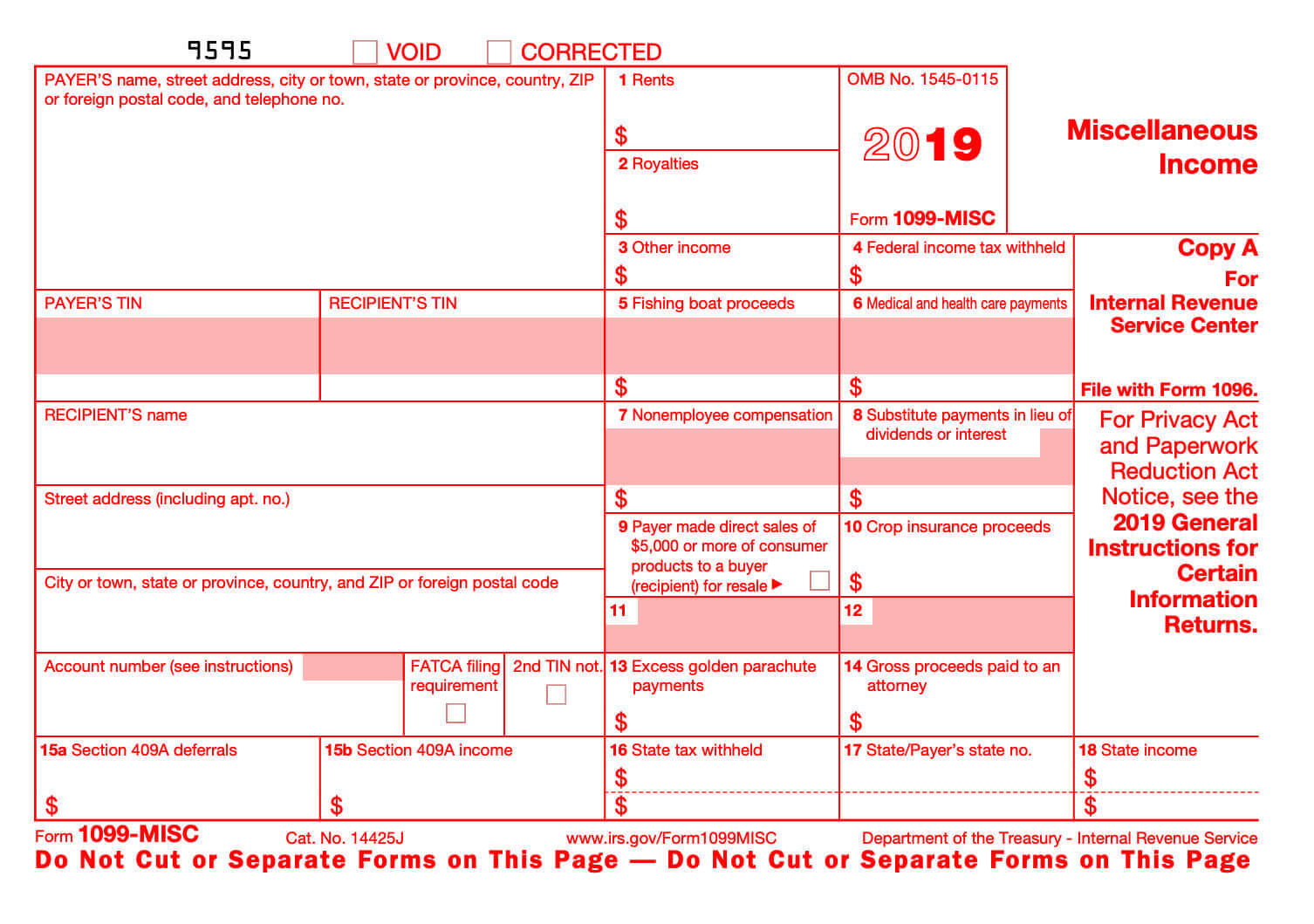

Major Changes To File Form 1099 Misc Box 7 In

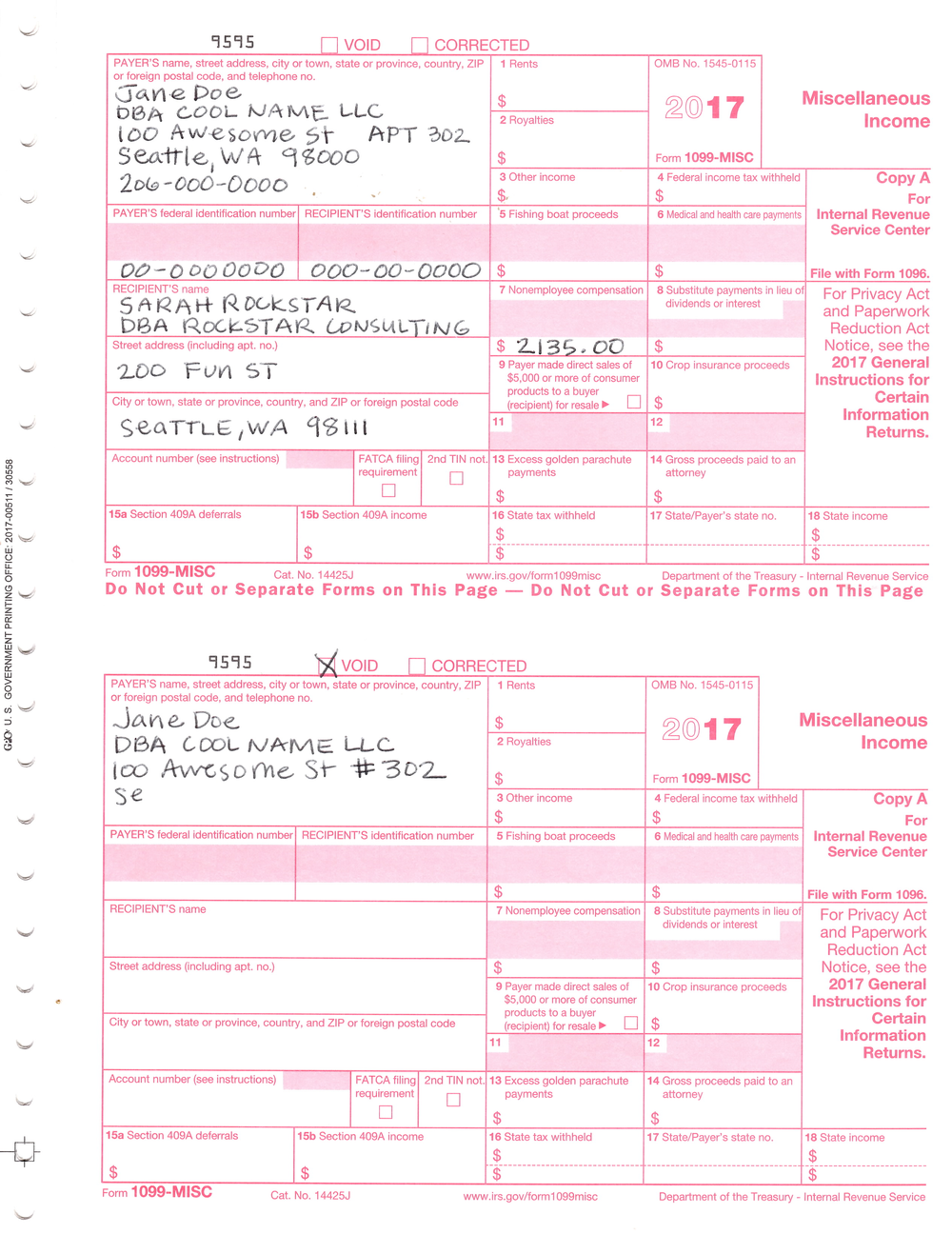

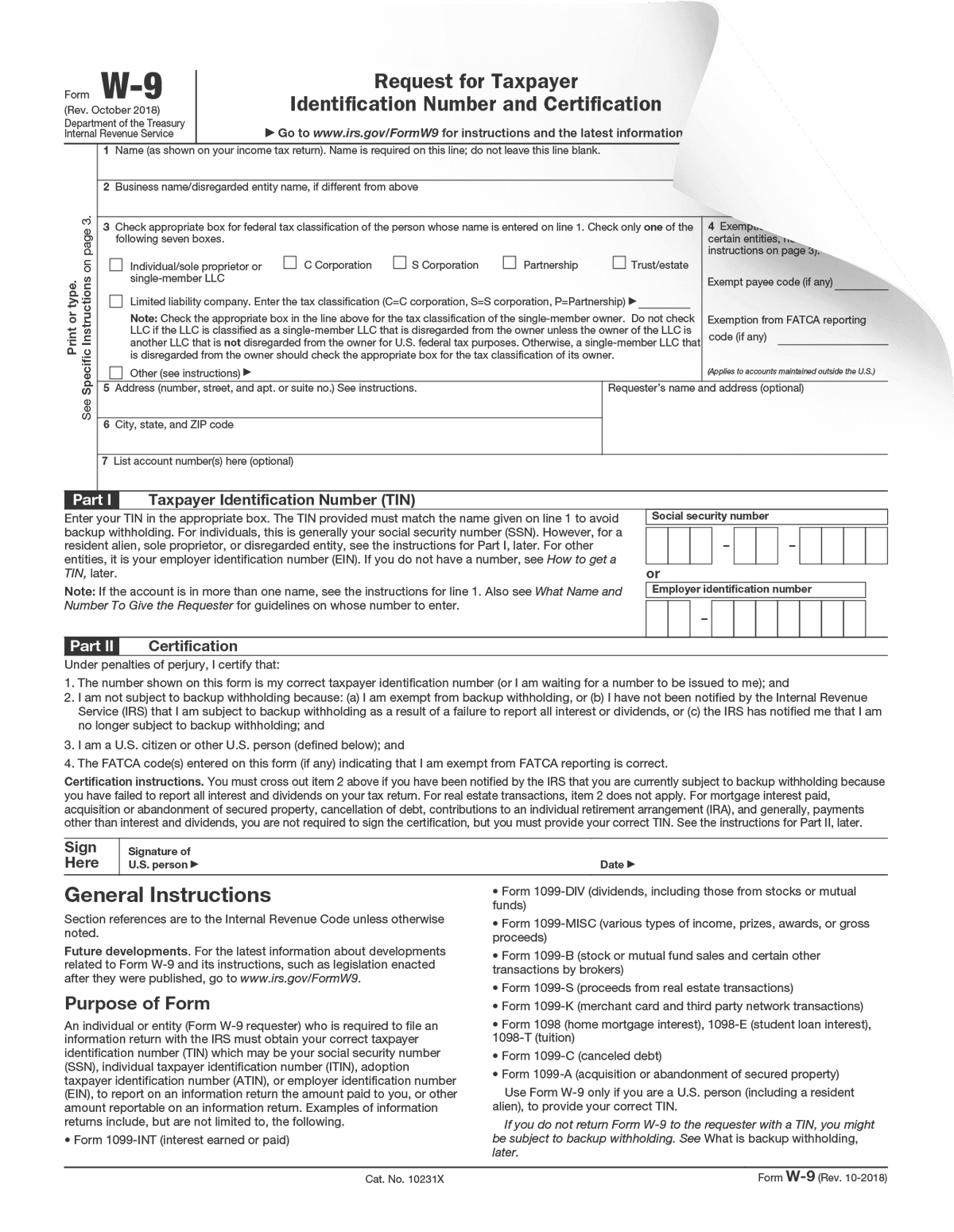

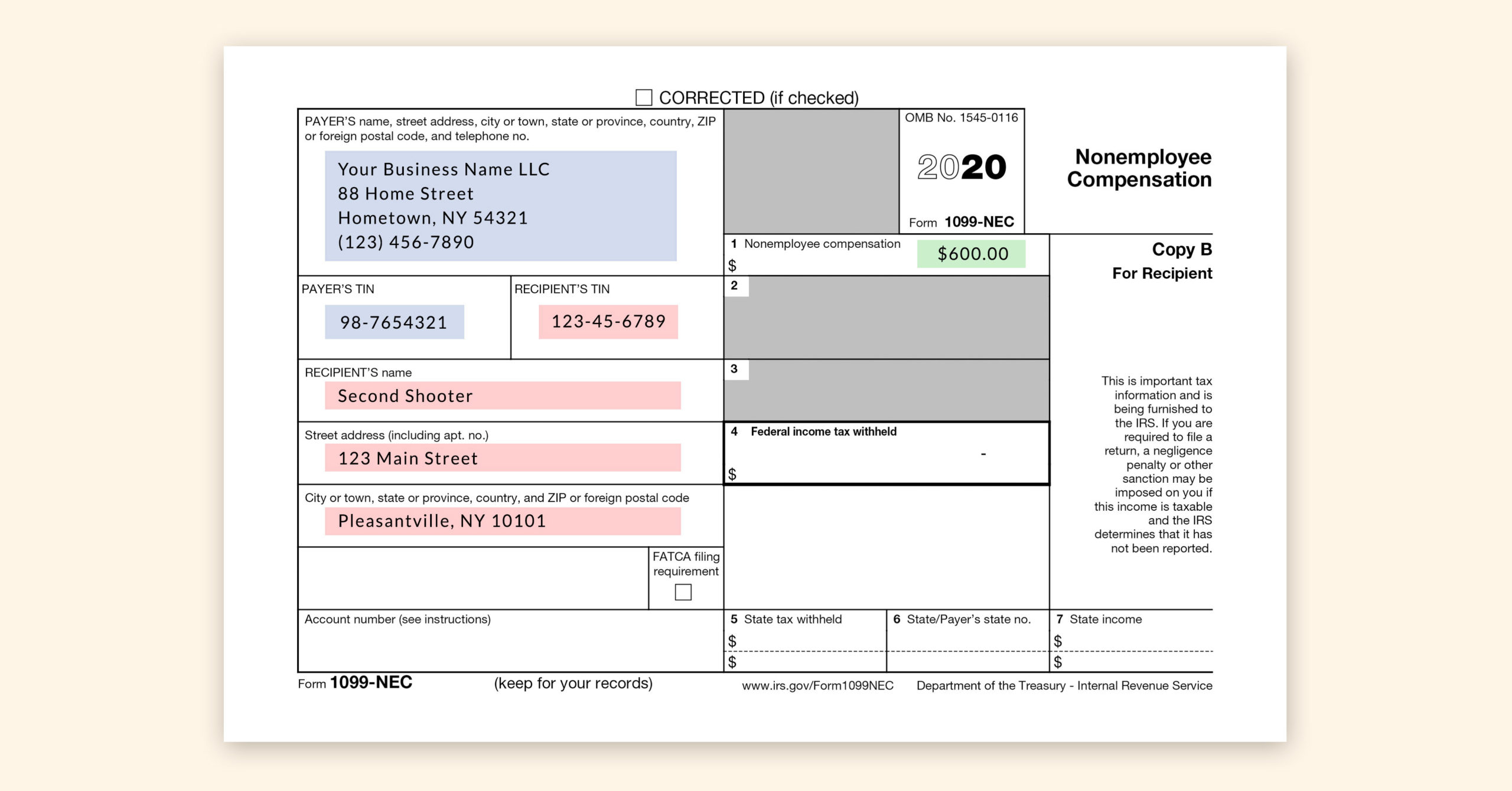

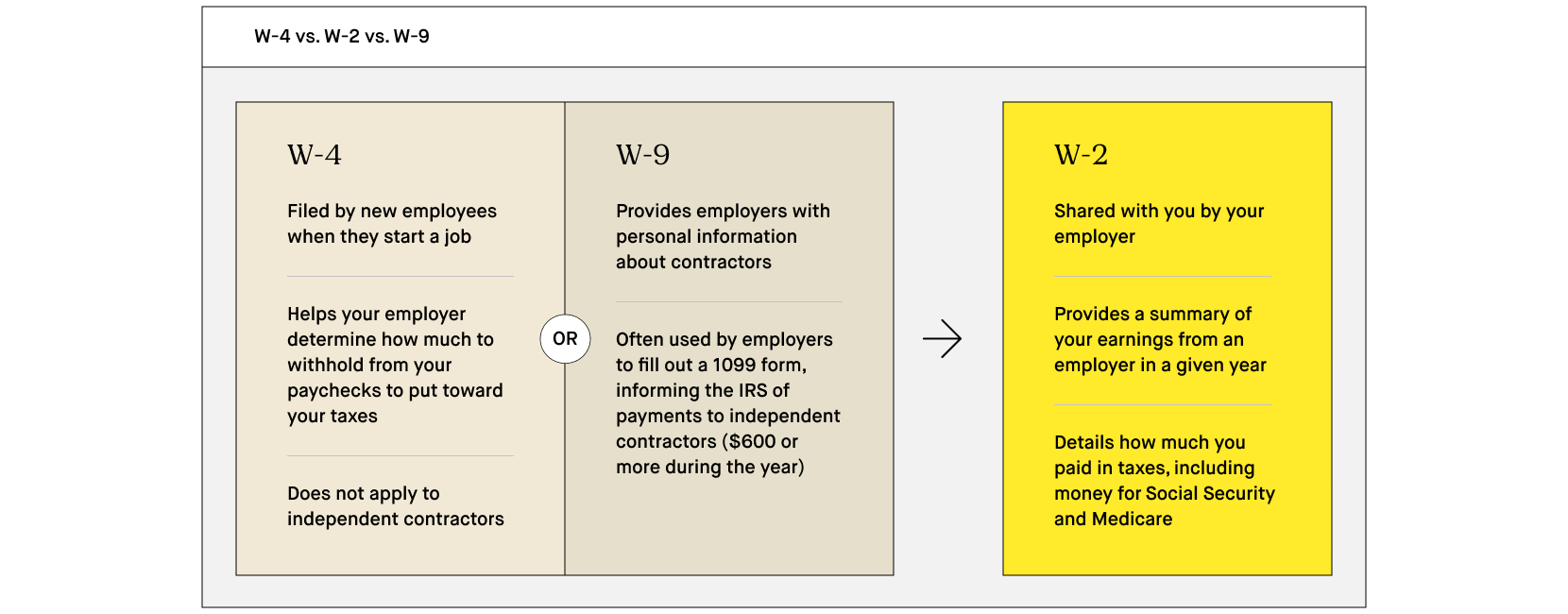

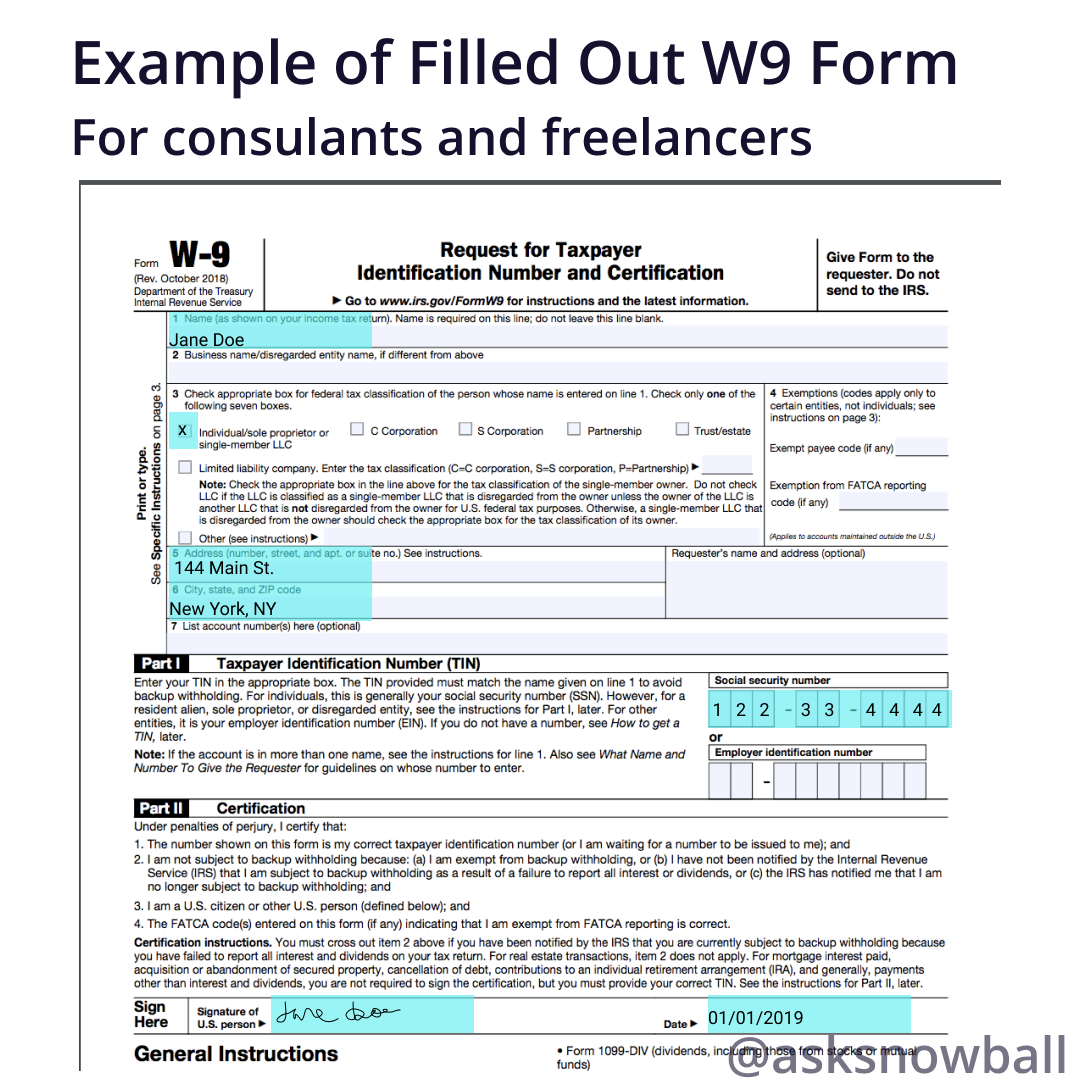

A To file the Form 1099MISC, you'll need a Form W9 and a Tax Identification Number (TIN) for each independent contractor The contractor provides you the Form W9 You should have every contractor fill out this document before services are provided This will ensure you have the information you need to file If you don't have a W9 for one of your serviceIndependent Contractor 1099 Income And Tax Returns, Deductions Do You Have Independent Contractor, Self Employed Income As Reported on a Form 1099 and Not Sure How To Prepare and eFile Your Taxes?Instead of Form 1099 MISC, the IRS announced last year it was reviving an old tax form, 1099 NEC, which hadn't been in use since 19 From tax year on, companies that hire nonpayroll workers and pay them more than $600 must provide them a 1099 NEC by January 31 If this is too many acronyms and numbers for you, check out the rest of this post to better understand the

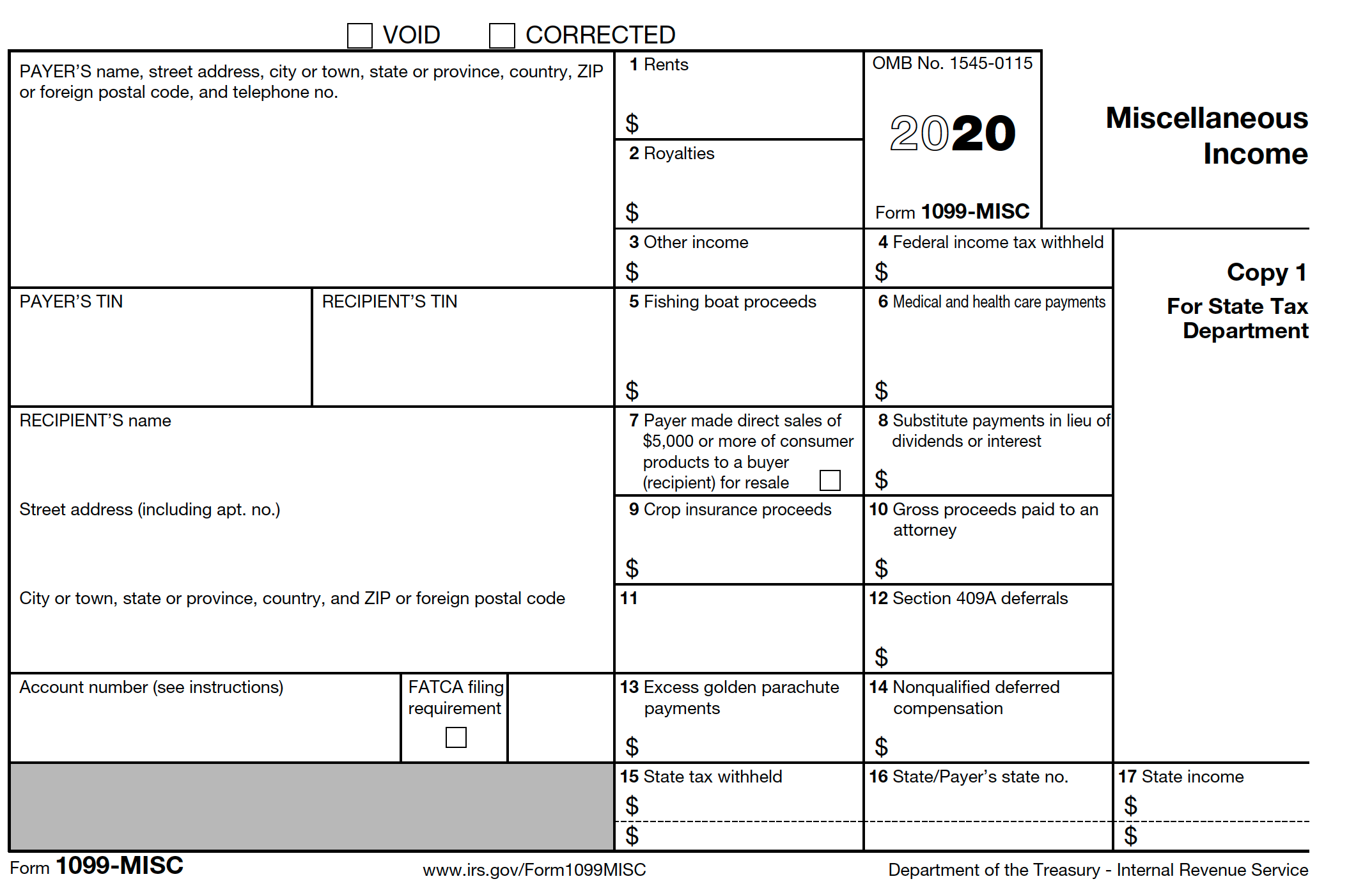

Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade If you are selfemployed, you can start with Form 1040ES (Estimated Tax for Individuals), and then file the other necessary forms with your 1040 Form during the tax season If you need help with a 1099 contractor needing a business license, you can post your job on UpCounsel's marketplace UpCounsel accepts only the top 5 percent of lawyers toTL;DR 1099NEC and 1099K forms report payments to independent contractors, while W2 forms report payments and withholdings for employees One of the key payroll differences between contractors

For the form used for independent contractors, see Form 1099MISC Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips (for which Form WIn short, independent contractors you paid $600 or more to in a year qualify for the 1099NEC form Of course, the IRS likes to keep things complicated, so there are exceptions You don't need to file a 1099NEC for independent contractors if they are a C corporation or S corporation The Form 1099 NEC is an exclusive form that business taxpayers will use to report all payments made to independent contractors or selfemployed professionals, starting from , the tax year This shows that Form 1099 NEC replaces 'Box 7' on Form 1099 MISC, which was where clients previously used to report payment for every nonemployee compensation

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Independent contractors handle taxes related to social security, medicare etc Employers have to produce a W9 to be completed by the independent contractor You may have to file information returns (form 1099MISC) to report certain types of payments made to independent contractors Generally, any payment in excess of $600 will require a 1099 How contractors use Form 1099NEC Most freelancers and independent contractors use Schedule C, Profit or Loss From Business, to report selfemployment income on their personal tax returns Here is the process for reporting income earned on a Form 1099NEC Part 1 of Schedule C reports income earned by the contractor The total amount earned on Form 1099NEC & Independent Contractors Category Small Business, SelfEmployed, Other Business How do you determine if a worker is an employee or an independent contractor?

1099 Misc Tax Form Diy Guide Zipbooks

Free Independent Contractor Agreement Templates Pdf Word Eforms

Perhaps the best way to track your income and business expense as an independent contractor is through spreadsheets Furthermore, it is beneficial while filling out 1099misc forms Open either Excel or Google Sheets to begin the expense tracking process Create four columns with labels like item, cost, date, and receipt In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W2 form are employees Payroll taxes from W2 employees are automatically withheld, while independent contracts are responsible for paying them W2 employees can also receive employment benefits, like workers' compensation andForm 1099MISC is out and 1099NEC is in Stay in the IRS' good graces, and avoid fines, by completing the new 1099NEC form on time and correctly DOL proposes new rule to define independent

Types Of 1099 Forms Shefalitayal

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

The contractor must complete IRS Form W9 Before the Independent Contractor Agreement is completed and signed the chosen freelancer must complete IRS Form W9 This records their Social Security number and Employer Identification Number (EIN) and allows their details to be kept on file by the client Create the Independent Contractor Agreement Now that the main outlineIRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the workNext up is Form 1099NEC As a contractor, you need to receive Form 1099NEC from every client who paid more than $600 to you during a year The IRS requests the clients to send the 1099NEC to every independent contractor until January 31st The form needs to indicate the amount paid to each contractor during the previous year Important note Starting from the tax

17 1099 Form Stock Photo Image Of April Independent

What Is The Difference Between Form 1099 Misc Vs Nec Taxbandits Youtube

Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them to the government on a quarterly basis Independent contractor taxes can be a bit tricky if you're used to filing a traditional 1040 form like most "regular" fulltime employees As with most taxation, there's a lot of confusion (and even deception) around the topic As an independent contractor, you won't get a W2 with a tidy list of your income and deductions Instead, every client that paid you more than $600 is required to send you a 1099 contractor form Clients that paid you less than $600 don't have to send one

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

What Is Form 1099 Nec For Nonemployee Compensation

Answer The determination can be complex and depends on the facts and circumstances of each case The determination is based on whether the person for whom the The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)For that year, you need to File a 1099 MISC Tax Form for your recipient who takes payment from you for their service An Independent Contractor

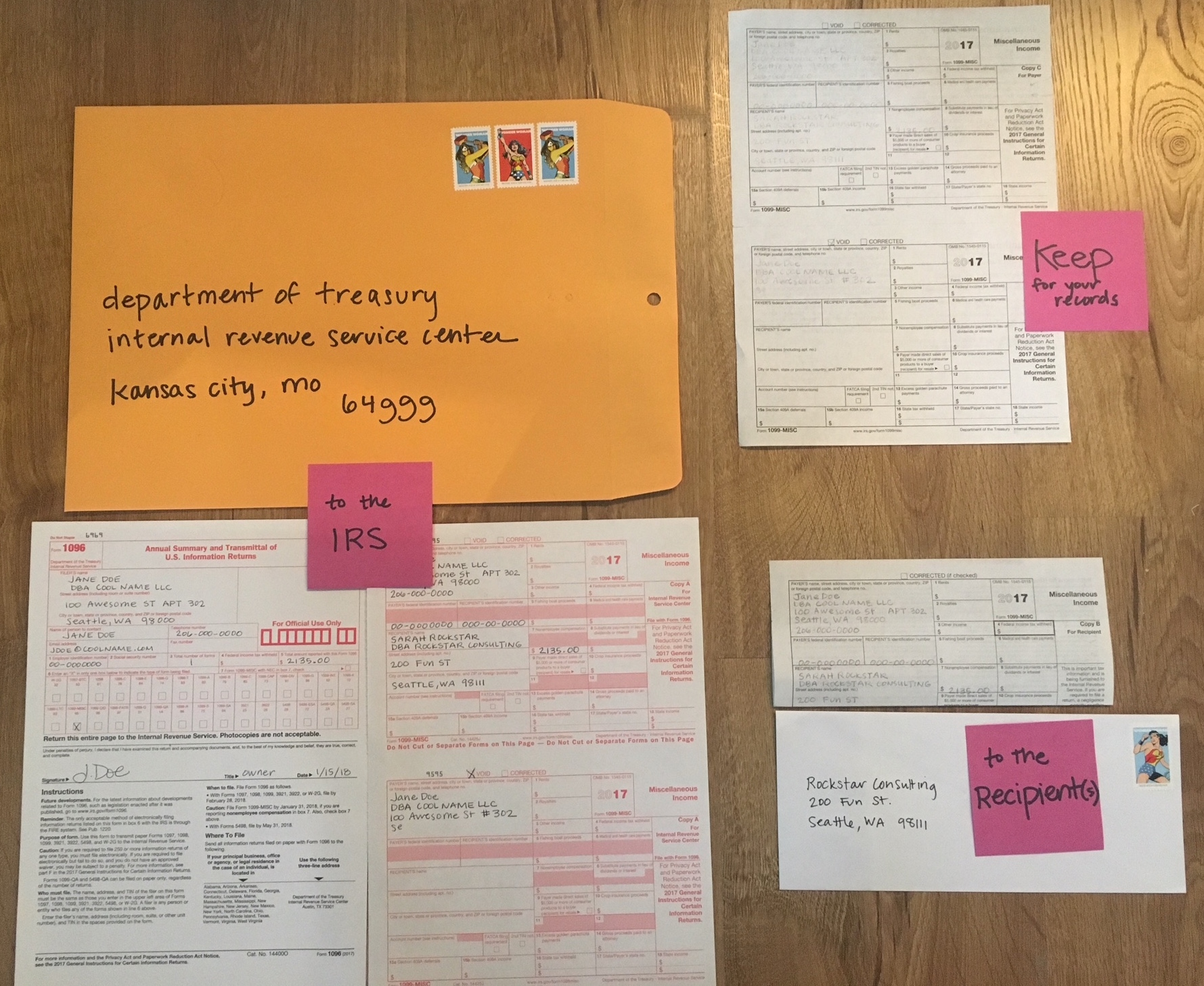

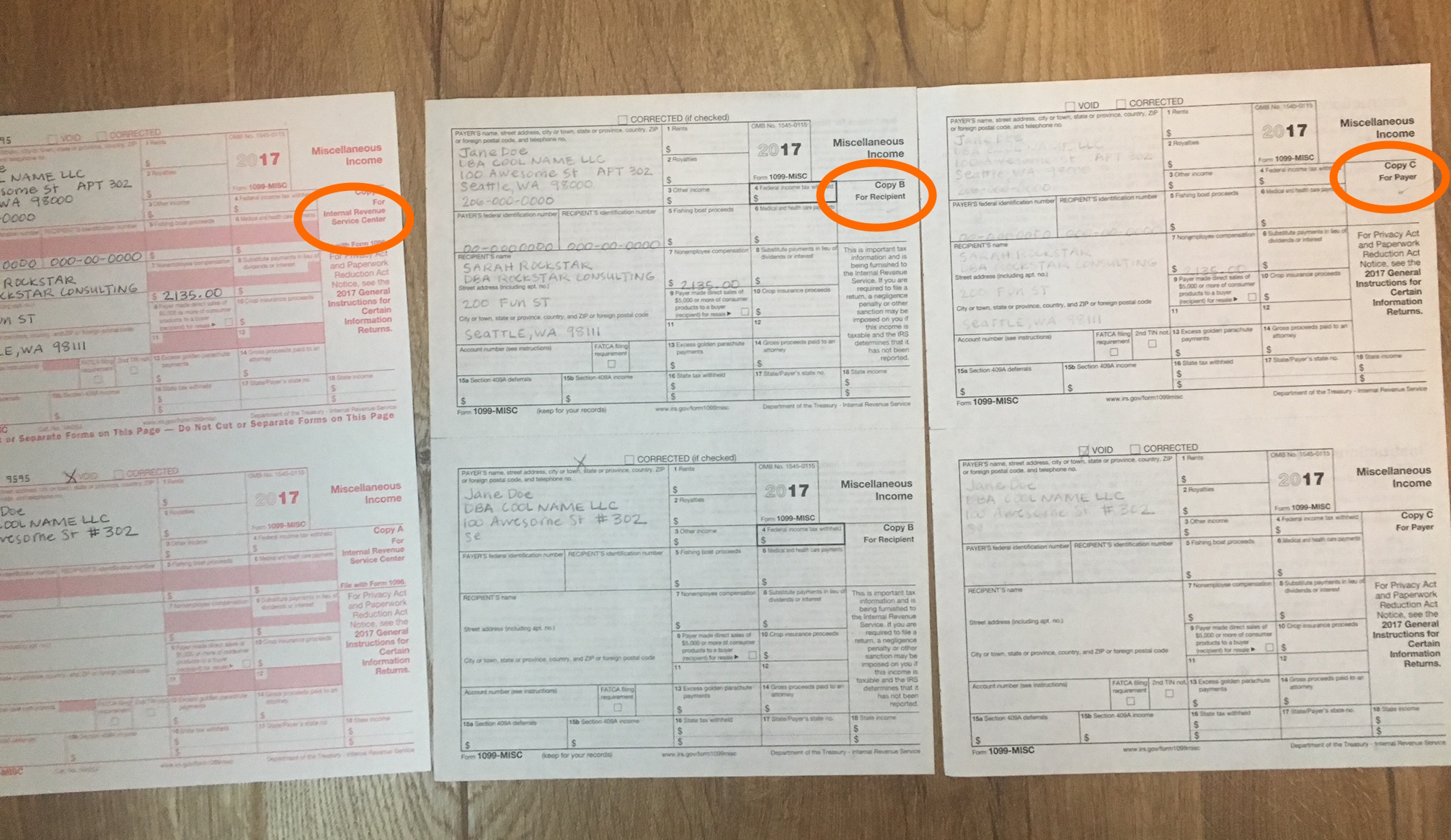

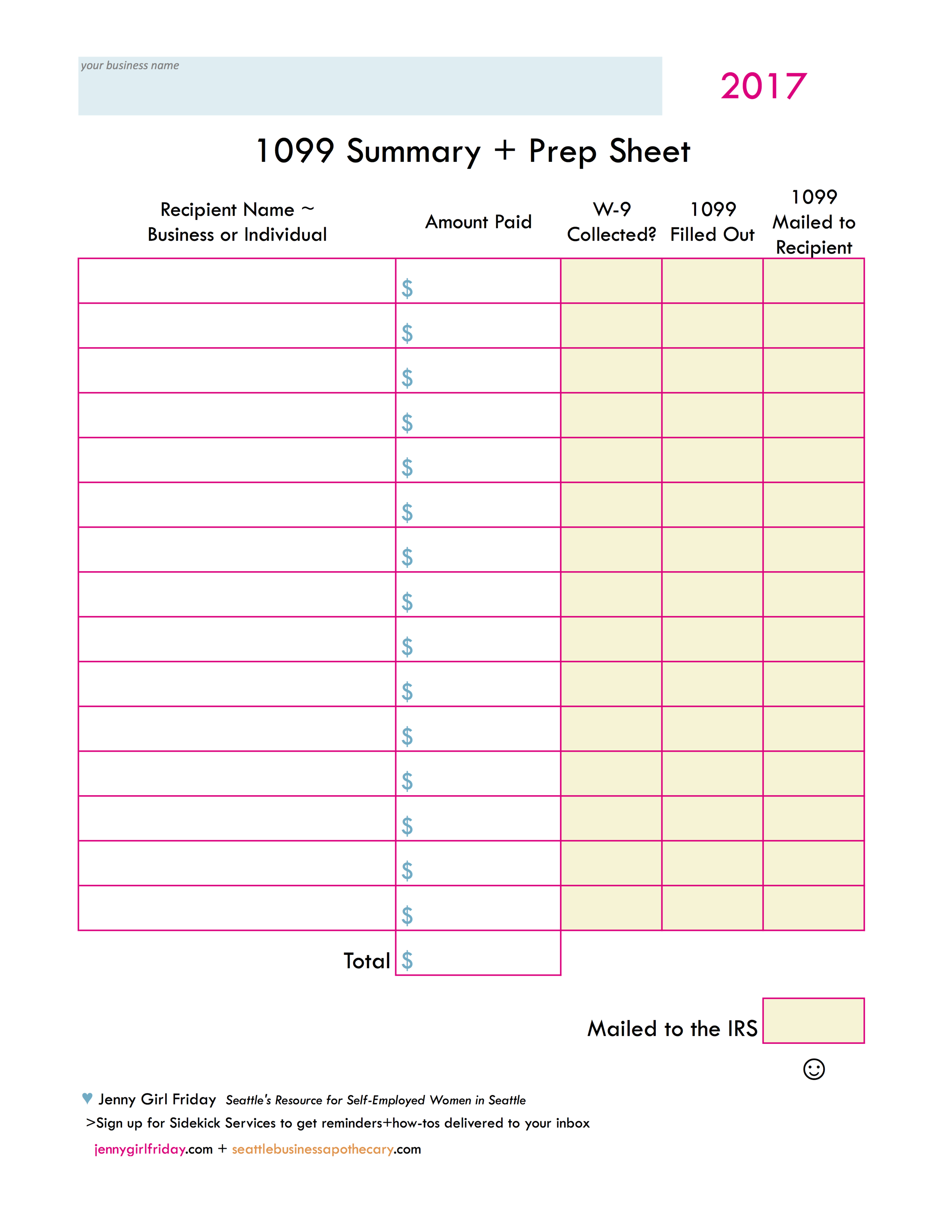

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

1099 Form Independent Contractor 17 Fresh Form 1099 K Paypal Models Form Ideas

Instead he is an independent contractor, or consultant, who is considered to be selfemployed Like most selfemployedThe term 1099 independent contractor refers to a person who provides goods or services to another but not as an employee The recipient of the services or products does not deduct your social security payments or tax withholdings from your payments For purposes of filing taxes, the employer provides the worker with IRS form 1099 instead of a W2 that employees use However, using from 1099 The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms After generating them, the pay stubs can be printed and stored or sent to the necessary parties

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

When you work with a 1099 independent contractor, do not withhold taxes Instead, you will provide IRS Form 1099NEC to each applicable independent contractor so that they can report their income on their tax return Give Form 1099NEC to contractors you paid $600 or more during the year When you submit Forms 1099NEC to the IRS, you must also send Form 1096 Form 1096 is the summary form For the 1099 MISC Form Filing process, go through our lines 1099 MISC Form for an Independent Contractor to whom you paid $600 or more amount START 1099 MISC When you paid more than or equal to 600$ to the non–employee during the year?Get Great Deals at Amazon Here http//amznto/2FLu8NwIRS Order Forms https//bitly/2kkMEkkHow to fill out 1099MISC Form Contract Work Nonemployee Compens

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Here, I walk you through applying for the Paycheck Protection Program (PPP) based on your gross income using Womply and their Fast Track application process To be clear "1099 workers" are not employees 1099 is a tax form for independent contractors, and independent contracts are not employees If you've heard the phrase "1099 employee," it is an oxymoron–there are no 1099 employeesFor an independent contractor, the employer is supposed to provide a duly filled copy of IRS Form 1099MISC It is for this reason that many people refer to independent contractors as 1099 workers and regular employees as W2 employees The classification of a worker as an employee or as a legal contractor can affect their legal rights California State has put in place various ways

All About Forms 1099 Nec And 1099 K Brightwater Accounting

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

1099 Form Independent Contractor While the income of workers is reported on Form W2 by their employer, independent contractors will collect Forms 1099MISC to report income to the IRS It is a common exchange between independent contractors and their customers To allow this to happen in the first place, the independent contractor must submitThe "1099" refers to the Internal Revenue Service form that an independent contractor receives stating his income from a given business during a given tax year A 1099 contractor is not an employee of the business or businesses with which he works;It's another story for freelancers and independent contractors who have their income reported on Forms 1099 If you are earning Form 1099 income you need to know your income tax bracket because you do not have the benefit of employer withholding and must send estimated tax payments to the IRS each quarter

Do You Need To Issue A 1099 To Your Vendors Accountingprose

1099 Misc Form Copy B Recipient Zbp Forms

Each employer they work for sends them Form 1099, which they have to fill in and return to the employer by January 31st as well Be aware that starting from the tax year , independent contractors use Form 1099NEC to report nonemployee compensation of $600 or more from a single employer

1099 Misc Form Fillable Printable Download Free Instructions

Form W 9 Form Pros

1099 Misc Instructions And How To File Square

Free Independent Contractor Agreement Pdf Word

W 2 1099 Here S What You Need To Know About Your Employment Status Nailpro

Swart Baumruk Company Llp

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

What Is A 1099 Misc Form Financial Strategy Center

What Is A 1099 Misc Stride Blog

Top 25 1099 Deductions For Independent Contractors

F 1099 Misc

Independent Contractor

Free Colorado Independent Contractor Agreement Word Pdf Eforms

1099 Misc Form Fillable Printable Download Free Instructions

It S Irs 1099 Time Beware New Gig Form 1099 Nec

Hey My Irs Form 1099 Is Wrong Maybe Intentionally

Instant Form 1099 Generator Create 1099 Easily Form Pros

1099 Misc Form Fillable Printable Download Free Instructions

2

1099 Misc Tax Form Diy Guide Zipbooks

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

1099 Vs W 2 For Employers And Independent Contractors

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Irs Tax Form 1099 How It Works And Who Gets One Ageras

17 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Independent Contractor Invoice Template Free Beautiful 7 Independent Contractor Invoice Invoice Template Estimate Template Excel Budget Template

The New 1099 Nec Irs Form For Second Shooters Independent Contractors Formerly 1099 Misc Lin Pernille

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

The New 1099 Nec Irs Form For Second Shooters Independent Contractors Formerly 1099 Misc Lin Pernille

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Hw Co Cpas Advisors

Reporting Income For Grubhub Doordash Postmates Uber Eats Contractors

What Is The 1099 Form For Small Businesses A Quick Guide

Filing Taxes 1099 Forms Every Independent Contractor Should Know About Moves Financial

W 9 Vs 1099 Understanding The Difference

Employee Vs Independent Contractor What S The Difference

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

1099 Form Colorado 17 Fresh Independent Contractor Employment Form Mersnoforum Models Form Ideas

What Is A 1099 Form 1099 Form 1099 Form Know How

New Jersey Continues Its Push To End The Misclassification Of Employees As Independent Contractors Morea Law Llc An Employment Law Boutique

Major Changes To File Form 1099 Misc Box 7 In

Who Should You Hire Independent Contractor Vs Employee Top Echelon

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

1099 Misc Form Fillable Printable Download Free Instructions

When Is Tax Form 1099 Misc Due To Contractors Godaddy Blog

Download 1099 Forms For Independent Contractors Inspirational Pretty 1099 Template Free 1099 Template 15 Models Form Ideas

Form 1099 Nec Form Pros

Irs 1099 Misc Form 1099 Misc Free 1099 Misc Form 1099 Misc Form By Form1099 Issuu

My Employer Says I M An Independent Contractor Does L I Cover Me

What Is A W 9 Form Robinhood

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

1099 Form 1099 Forms Taxuni

3

Laser Set 2 Up 1099 Misc 4 Part Hrdirect

What Is A 1099 Business Owner S Guide Quickbooks

/types-of-1099-forms-you-should-know-about-4155639-2020-83d4b735c1d64ecc93ba821369146618.png)

7 Key 1099 Forms You Need For Business Taxes

Irs 1099 K 17 Fill And Sign Printable Template Online Us Legal Forms

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Employees Everything Employers Should Know Vensurehr Blog

1099 Misc Form Fillable Printable Download Free Instructions

Order Irs 1099 Form 17 Beautiful 1099 Form Independent Contractor Models Form Ideas

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

What Are Information Returns Irs 1099 Tax Form Types Variants

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Tax Update For Owner Operators And Fleet Owners Mission Financial

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

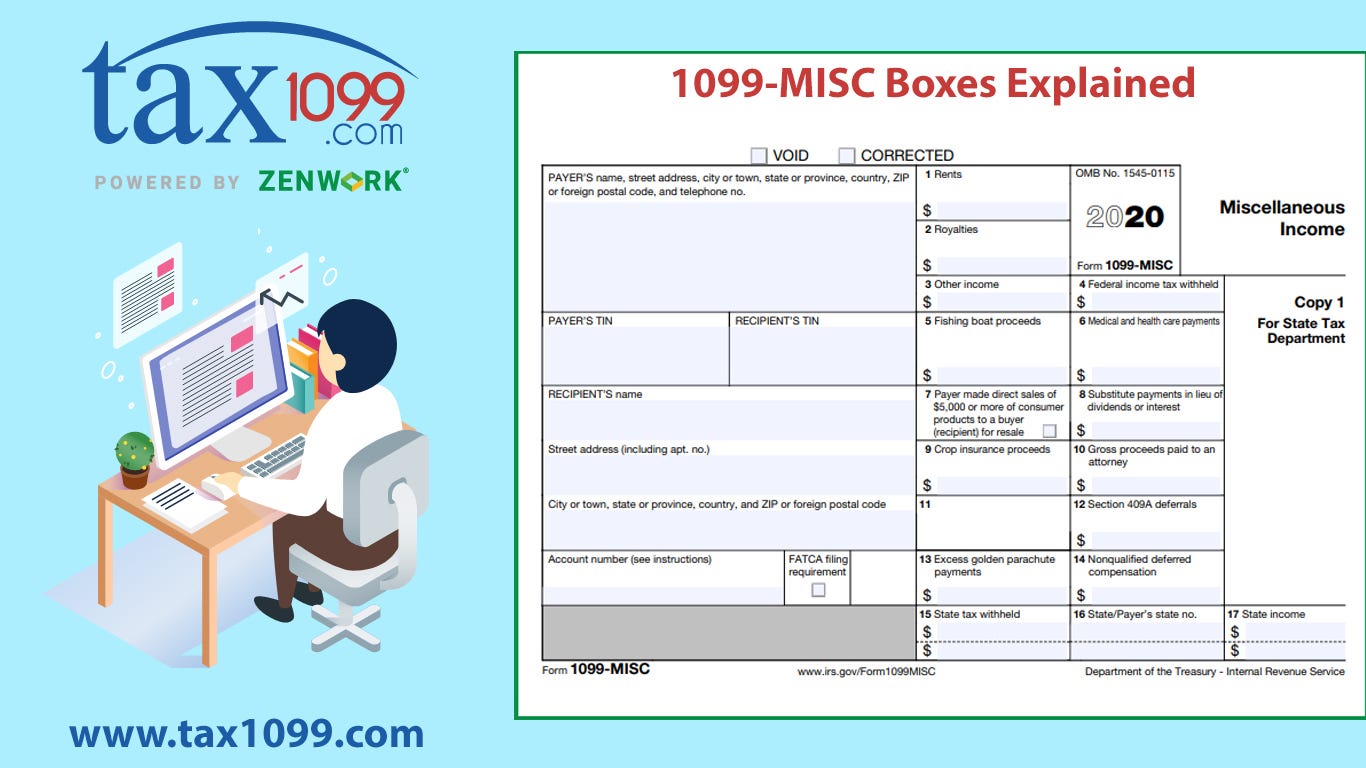

How To Read Form 1099 Misc Boxes And Descriptions By Tax1099 Com Irs Approved Efile Service Provider Medium

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

How To Fill Out A W 9 19

Irs Tax Form 1099 Misc Instructions For Small Businesses Contractors

1

Change Is A Good Thing Hype S Talent Is All W2 Variable Hour Employees

Independent Contractor Taxes Guide 21

When Do You Need To Use Form 1099 Misc Contact Fma Cpa Today

Printable

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

1099 Misc Laser Federal Copy A Hrdirect

0 件のコメント:

コメントを投稿